The Report

of the Iraq Inquiry

Resource

Accounting and Budgeting (RAB) has two key elements. First, costs

are

recorded

when resources are consumed rather than when the cash is spent.

Second,

to provide

a more accurate and transparent measure of the full economic

costs,

RAB incorporates

non‑cash costs including:

•

depreciation –

the consumption of capital assets over their useful economic

life;

•

impairments,

such as stock write‑offs; and

•

a cost of

capital charge – the opportunity and financing costs of holding

capital.

The

introduction of RAB by the Government was intended to create an

incentive for

departments

to reduce non‑cash costs, for example by reducing the amount and

value

of assets

and stocks held.

Under RAB,

the total Departmental Expenditure Limit (DEL) comprised three

elements:

a resource

budget (RDEL); a capital budget (CDEL); and adjustments to reflect

non‑cash

costs.

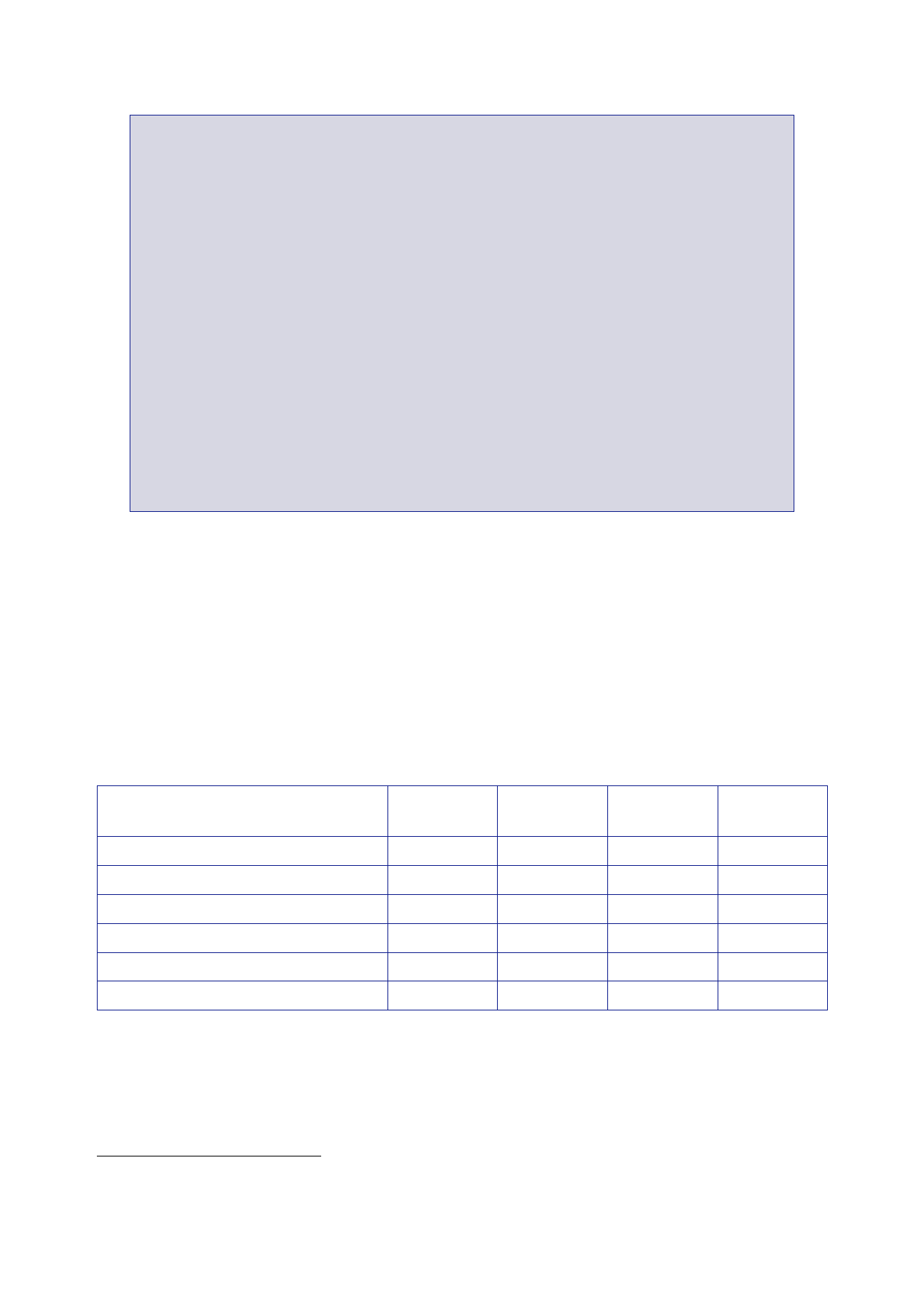

402.

While the 2002

settlement was presented in RAB terms, in order to

allow

reconciliation

back to previous settlements and to aid public presentation, the

letter also

gave an

estimate of the cash spending associated with the settlement. The

table below

presents

that estimate.

403.

The change

from cash accounting to RAB presented an opportunity for the

MOD

significantly

to increase its available cash by reducing its non‑cash costs

(depreciation

and the

cost of capital).

Resource

DEL

Capital

DEL

Less

depreciation

Less cost

of capital

Less other

changes

Estimated

cash spending

2002/03

(Baseline)

31.4

5.5

7.6

5.1

–

24.2

2003/04

Plans

33.0

6.0

8.1

5.2

0.1

25.6

2004/05

Plans

33.8

6.3

8.3

5.3

–

26.5

2005/06

Plans

34.7

6.9

8.8

5.4

–

27.4

404.

Mr Hoon

replied to Mr Boateng’s letter of 10 July on the same day,

welcoming the

proposed

increase in defence spending but pointing out that, in terms of

what the UK

was

expecting its Armed Forces to do, it was a “taut”

settlement.237

237

Letter Hoon

to Boateng, 10 July 2002, ‘SR2002: Ministry of

Defence’.

508